As the pandemic has progressed through 2020 we have seen the ups and downs of economic activity and the struggles of an industry to maintain the vital trade links that support a nation. Consultant Jon Monroe chronicles these events weekly. As the Lunar New Year ends Monroe gives us his own, inimitable, take of the week in a Pandemic.

China is open for business. The year of the bull begins. Good luck to us all. This week we are hearing good news on the Covid front. Daily vaccinations are increasing weekly and 45 of our 50 states are experiencing a declining growth of infections into the weekly single digits.

We are hoping that during the next few days we will see the results of the carrier’s work during the holidays; clearing the backlog of containers at Asia origin ports. China driver shortages may prove to be a blessing in disguise.

We still need to slow down the movement of containers to the US and allow time for the ports to clear their terminals of the container congestion. This container pandemic has spread to the railroads as they struggle to handle this inbound volume of containers to inland ramps that are backed up due to lack of chassis.

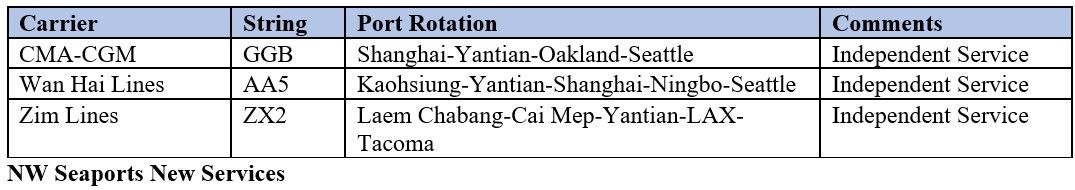

In the meantime, carriers are moving new vessel strings into alternate ports, bypassing the ever-congested Los Angeles and Long Beach terminals. The Northwest Seaports are finally getting some carrier love that they have been missing for so long. Think Seattle Tacoma. Three new carrier services have been introduced into the Seattle-Tacoma ports.

Finally, some good news on the Covid pandemic. Not that there is anything good associated with Covid. But we are seeing good results in our response to Covid. The vaccines seem to be effective and each week we are increasing the number of daily doses administered.

This past week we achieved 55.21 million doses administered including both 1st and 2nd round vaccinations. This is 12.01 million vaccinations over the previous week or 1.71 doses administered per day. This compares with 1.49 million doses the previous week.

We heard this week that we will have 600 million doses available by the end of July. In order to get everyone vaccinated by the end of August we would need to get to 2.88 million doses per day from here on. We would need to increase our vaccination administration count by 1.7 million per day. We keep climbing each week so it might be possible.

In the past week, 45 of 50 states COVID growth declined vs the week before. A good sign. Let’s get our economy moving again. In case anyone hadn’t noticed, most of it is sitting in the San Pedro harbor waiting for a berth.

More good news: The top 11 states average Covid growth declined 2.2% when compared to the week before. This is great news as this is the fifth week in a row that the top 11 states have posted a decline in Covid growth over the previous week.

California is down to 1.7% growth which is great news and below the 11.7% Covid growth during the first week of 2021. Every state of the top 11 but New Jersey beat last week’s numbers. All of the top 11 states are posting low single digit growth in Covid infections.

Analysts are attributing this positive sign to the acceptance of mask wearing, social-distancing and the frequent washing of hands. People are finally learning that being safe is better than the alternative.

The Rat is finally gone, and the Bull is here. Perhaps it is only me, but I can see the symbolism in these two Chinese signs as we move from one to the other. The Rat symbolises pestilence which we have fought through for the better part of 2020.

The Bull signifies the comeback of our economy and way of life. Let’s hope it works out this way for 2021. So far, so good. China is now back at work (first day back). We will know in just a few days how strong the post Lunar New Year bookings will be. But all indications thus far are on the side of a continued surge of bookings that exceed supply of equipment and space.

The open-ended question is when truck drivers will return to work? Will China maintain their rule of a two-week quarantine for the returning drivers? We still do not know how well the carriers were able to clean up the backlog at the Asian ports and the status of empty containers.

It will no doubt vary by load port. It may also take a day or two to determine how many factories are open and how long it will take them to get to full staffing. Very often factory workers trickle in and it takes a few weeks for factories to get all of their workers back in place.

This year travel was limited in many areas and according to the China news feeds travel was down in excess of 60%. This means only 100 million people were travelling. Still a lot of people, but a lot fewer travellers than last year. Please note in the chart below, driver availability by port for this week is highlighted in yellow. With the exception of Dalian and Qingdao driver availability is expected to be between 10% to 20% for this week.

It seems that 2020 has rolled into 2021 as the year started with a bang. January’s retail sales showed strong gains posting a 9.2% year over year increase excluding automotive and gasoline. Home is still where the heart is, and it seems it is still where the money is spent.

Furniture and home furnishings climbed 16.6% when compared with last January. Even apparel is trending up. Finally, Department Stores deemed non-essential retailers last year, are up 1.5%, driven by a 27.9% increase in online sales. Department stores online? Macy’s, a traditional brick and mortar retailer has revamped its strategy and expects digital sales to account for 40% of total sales in 2021.

Given that this means off mall sales, what does it mean for the future of mall traffic? Though analysts differ on the demand expectations for 2021, it is looking like demand will be strong through the first half of 2021 and possibly through the entire year. But the most exciting statistic is the shift toward online sales. Online sales in January were a key driver in retail sales growth at a 62.1% when compared to January of 2020.

The NRF is forecasting record imports through June. Importers have low inventories and are on a replenishment drive. Most importers are buying early in order to account for delays to meet seasonal demands.

Remember Easter last year? Me neither. In spite of the uncertainty, quite a few industry analysts are forecasting growth of imports into the 6 to 9% range. Add to this the upcoming stimulus and this could easily take volumes into and through peak season. This would most likely take us through Chinese New Year. I may be wrong, but my bet is this volume will be sustained through post Lunar New year 2022. So where are we headed in 2021? Choppy waters ahead as we navigate more of the same as to what we experienced in 2020.

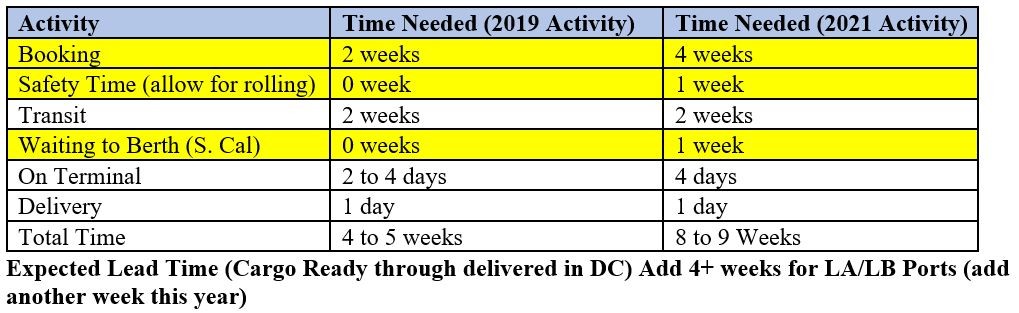

The chart below reflects the new normal for lead time. Add four to five weeks to your current order cycle for west coast delivery.,

Where are bookings post Lunar New Year? This is the first day. We can hope it will start out slow given the lack of drivers to pick up and deliver containers to the terminals at origin ports. We need the time to clear up the congestion at ports in the EU and US.

NVOCCs are caught smack in the middle of this container pandemic. BCO volumes continue to be strong and early orders will keep volumes high for quite some time. BCOs are still counting on NVOCCs to clean up the mess and obtain the badly needed equipment and space.

Working at a load port is quite stressful these days, especially if you are responsible for obtaining and confirming bookings with the ocean carriers. It seems many BCOs sandbagged their volumes on their MQCs while others had major volume increases they hadn’t counted on.

This was not the year to get caught short. Someone came to me last week with 60 containers per week thinking they had hit the mother lode. They of course expected it was a big deal until I told them my nine-year-old son can get 60 containers per week if I gave him space.

That is the reality of how 2020 changed our lives. The power has shifted from those that have volume to those who have capacity. The question that we have as we move into 2021 is how will the carriers manage their customers? What will a contract look like? What is the sanctity of a contract? And finally, what per diems and terms can I get? Notice I haven’t said anything about rate. Rate is whatever it is this year. Get the MQC. Of course you need to be in the market. But do not haggle over US$50-US$100. Haggle over another 500F of MQC.

Carriers

Carriers are struggling to manage assets in an environment where containers are scarce and ships are full. Some say they are taking advantage of the situation. But they have not made decent money in years. As we began 2020 most carriers were scrambling to secure a billion dollars in financing as their world crumbled around them due to the shut-down of economies in their major markets. And miraculously, the sky opened up and the sun shone on the container shipping industry with a rebound the likes of which no one expected.

If there was ever a come from behind story, this was it. But did it go too far? Rates have skyrocketed five times contract rates and importers are feeling the pain. How will we now get through 2021?

This year, every carrier executive must be playing golf and having three martini lunches. Carriers continue to post record profits and this week Hapag-Lloyd revised their estimated first quarter earnings upward. Hapag-Lloyd expects to make US$1.5 billion EBIT, with a B, compared with US$176 million EBIT in the first quarter 2020. That is 8.5 times last year’s first quarter numbers. WOW! Who would have thought?

Let’s put this into the proper perspective; Hapag-Lloyd had a good 2020 and their EBIT for the year was US$1.5 billion. In other words they are expecting to make in the first quarter, what they made through the whole of 2020.

Ports

Most carriers are coming to grips with the reality that Los Angeles and Long Beach ports will not clear up anytime soon. Alternate ports are being initiated on new vessel strings. A number of carriers are pulling strings and moving north along the west coast to Oakland and Seattle or Tacoma, or both.

As you read this report, China has returned from the Lunar holiday. Or have they? As China entered the Chinese New Year holiday many factories cancelled bookings though they continued to work. The problem? Finding drivers to pick up and deliver containers to the terminal.

We are hopeful that some of the port backlog at China ports will be cleared. While both terminals and factories may have continued their work through the Lunar holiday, most drivers went home for the holiday. This means that when everyone returns to their offices and factories today, they may still have trouble finding drivers. Those who travelled, are required to be in quarantine for two more weeks. That brings us to the 3 March. In the meantime, we expect factories to resume bookings to get product scheduled and off of the factory floors.

Congestion

Coming to a port near you. It is no longer a matter of which ports are congested; it is a matter of when the congestion will be cleared. With the exception of maybe Charleston, most ports are backed up with vessels waiting for a berth.

As if we didn’t have enough problems already, the weather steps in to further back up congestion at the ports. Both BNSF and the UP cancelled services from the West Coast ports to inland locations due to weather. In the Northwest, six trains have been waiting for power (engines) to move inland. In the meantime the port will experience a backlog of containers as carriers continue to arrive. The Northwest Seaports of Seattle/Tacoma are the newest beneficiaries of arriving vessels that are diverted from California ports. Finally, the NW Seaports are feeling the love from the carriers.

Looking for an alternate port to minimise waiting time and disruption? Think about Charleston. I learned from Pat Dinon, who represents the Charleston port, that they have no vessels waiting to berth, no port congestion, no chassis shortage, and the velocity through the ports one can only dream of after experiencing the wait at other ports. It seems they are close to adding another terminal soon. If this is not enough, they have an on terminal cross dock facility. You can reach Pat for more info at: [email protected]

The situation in the Southern California ports of Los Angeles and Long Beach have not changed. If the update below looks like last week’s update, it is because it is. And it only seems to get worse. If the carriers continue their limited blank sailings, it may continue like this for some time.

In the US, the most seriously impacted ports are the Southern California ports of Los Angeles and Long Beach. There are currently between 35 and 40 vessels waiting for a berth in any given week. In the meantime, more (4) extra loaders sailed Asia last week destined for Southern California and (3) more sailing Asia ports this week. Neither week has any blank sailings scheduled. Add to this the slow – down in operations due to the almost 700 Covid infections at the two ports. Jon Decesares of WCL Consulting identified six key issues at the Southern California ports in his recent newsletter.

- Vessel bunching at ports (35 to 40 vessels anchored in the harbour waiting for a berth)

- Congested Marine terminals (no more space for containers)

- Shortage of skilled equipment operators on the docks (more so since almost 700 workers were infected with Covid)

- Long truck queues at gates

- Limited appointment availabilities

- Chassis shortages (Truckers hoarding chassis and importers with long free time – 10 to 14 days)

- Distribution facilities filled to near capacity with labour shortages.

It should also be noted that due to the complexity of the Southern California ports (multiple terminals operating a landlord model), the situation is more difficult to resolve quickly. Of course, add to these points the fact that 45% to 60% of this country’s imports are moving through the LA-LB ports.

Tiếng Việt

Tiếng Việt